Helping to Bring You Peace of Mind

Through Life’s Hardships

![]()

Probate is often a stressful and emotionally tumultuous process. Probate is the court-supervised process that occurs after someone dies, in which the court gathers the decedent’s (deceased individual’s) assets, pays off any debts or taxes, and distributes the remainder to beneficiaries.

For many beneficiaries, probate happens during a time of grief. This can make the process stressful, especially if bad actors or unhappy beneficiaries try to alter an existing will or gain access to assets through unscrupulous means.

At Johnson/Turner Legal, our Minnesota probate lawyers shoulder the burden of probate for our clients so they can focus on honoring the decedent’s memory. We assign an experienced probate attorney, two paralegals, a client engagement specialist, and a life coach to every case. This multi-faceted approach allows us to identify your needs accurately and guide you through probate with confidence.

Schedule a consultation from with a probate attorney in Minnesota. Contact us online or call us at (320) 299-4249.

Why probate? The main purpose of probate is to transfer ownership of property from the person who owned it, but has died (the decedent), to his or her heirs and beneficiaries. If there is no property to transfer, there is usually no need for probate.

Probate also allows any taxes and debts that are owed by the decedent to be paid, and it sets a deadline for creditors to file claims (this prevents old or unpaid creditors from haunting the decedent’s heirs or beneficiaries) and for the distribution of the remainder of the decedent’s property to the rightful heirs.

If the decedent’s property included land in another state, the laws of the other state govern who inherits it unless there is a will. If there is a will, after it is admitted to probate in the home state of the property, it usually must be submitted to probate in the other state. This other probate procedure is formally referred to as “ancillary probate.”

If there is no will, probate is usually required in each state where the property is situated, in addition to the home state. Contact us to learn more about Minnesota probate law.

Before we cover how our team of Minnesota probate attorneys here at Johnson/Turner Legal handles probate, it’s important to first establish common issues that arise during the process.

During probate, you can expect to deal with the following issues:

There are four different types of assets commonly involved in probates:

During probate, the Personal Representative and court work together to determine how assets are liquidated to repay creditors (if necessary), as well as take the necessary steps to make sure the decedent’s will is followed to the letter and beneficiaries receive the assets left to them in the will or trust.

To determine whether probate is necessary in your case, we recommend scheduling a consultation with one of our probate lawyers in Minnesota here at Johnson/Turner Legal.

A will cannot transfer property, so probate is generally necessary even with a will, though it depends on the value and the nature of the property. For smaller estates, there is a less formal procedure that must be followed before the deceased’s property can be legally distributed. But even that is still under the general supervision of the probate court.

If a person dies with a will, a court generally has to provide an opportunity for others to object to the will and, if there are any objections, determine if the will is valid. Some things that can invalidate a will:

For example, if the deceased owned real estate in his own name, no knowledgeable outside person would accept title to the property, and no bank would lend a new buyer mortgage money on it, unless the estate went through probate so “clear title” could be given to the new owner.

Similarly, few outsiders would enter into any other transactions involving the deceased’s property before the will is “admitted to probate” and someone is lawfully appointed to act for the estate. Feel free to contact a Minnesota probate lawyer from our team for more information on how to probate a will.

At Johnson /Turner Legal, we help our clients tackle every step of the probate process head-on, so they never feel alone.

When you bring us on board to help you with a probate process, these are the steps we take:

We make a difference to our clients by offering them three things:

The death of a loved one can start a complicated, confusing, and sometimes expensive process called probate. Grief can make it very hard to face pressing issues and make sound choices. We’ll help you get from the start to the end of the probate process.

“To build trust and provide comfort to our clients and legal professionals by reinventing the delivery of legal services.”

Partner, Attorney

Paralegal

Paralegal

Attorney

Attorney

Attorney

Marketing Coordinator

Partner, Attorney

Senior Client Service Representative

Chief Operating Officer

Client Engagement Specialist

Paralegal Assistant

Client Service Representative

Intake Specialist

Intake Specialist

Head of Intake Specialist Team

Senior Paralegal

Senior Paralegal

Partner, Attorney, Family Law Mediator

Senior Paralegal

Associate Accountant

Client Service Representative

Client Service Representative

Senior Paralegal

Operations Manager

Senior Paralegal

Client Engagement Specialist

Attorney

Senior Paralegal

Engagement Support Specialist

Attorney

Director of Legal Practice Operations

Partner, Attorney

Partner, Attorney & Family Law Mediator

Client Engagement Specialist

Senior Paralegal

Attorney

Partner, Attorney

Attorney

Marketing Manager

Coach

Attorney

Our employees are the key to the success of our clients, and ultimately of the firm. We strive to create a culture that instills a sense of belonging. We want to provide our employees with a safety net, which empowers them to take risks and make leaps, while knowing that others will support, assist and, if need be, catch them. Maintaining a firm culture of shared vision, open communication, positive work environment and friendships will foster a cohesive team of professionals working together to champion the successes of our clients, our community partners, and the firm.

We believe the legal industry needs to break free from its stale and uncreative practices in order to serve the needs of today’s clients. We seek to lead the way in revolutionizing the way consumers experience legal representation. We strive to reinvent all major facets of the delivery of legal services, including how we involve our clients in our representation through information sharing and communication, how we produce legal documents, manage cases, and price our services. We understand the challenges that come with innovation, and strive to support one another’s new ideas.

We strive to ensure that our attorneys and staff are fully versed in their practice areas to provide our clients the best advice and representation. The knowledge necessary to do so includes not only mastering the letter of the law, but also understanding trends in the interpretation and application of the law. We are life long learners who know there will never come a day when we have all the answers. We nurture and rely on our strong network of relationships within the firm and beyond. We study; we reflect; we converse; and we challenge one another. Our depth of knowledge sets us apart.

We all experiences life’s challenges, whether as part of our day-to-day routines or as a result of an event or transition in one’s life. Johnson/Turner Legal strives to help its clients and the legal profession rise through such challenges. Whether by pursuing fairness and justice, by solving problems or by bringing new perspective, Johnson/Turner Legal is dedicated to building trust and providing comfort.

We are a service organization, helping people through challenges and transitions in their lives. Our work must extend beyond our clients to champion the success of our colleagues, friends and the communities at large in which we live and work. We work to improve our communities through volunteerism and leadership.

Bloomington

8400 Normandale Lake Blvd., Suite #920 Bloomington, MN 55437

Open hours Mon-Fri 8am – 5pm

Map & Directions

Burnsville

1509 Southcross Dr W, Suite 204

Burnsville, MN 55306

Open hours Mon-Fri 8am – 5pm

Duluth

230 West Superior Street, Suite #400

Duluth, MN 55802

Open hours Mon-Fri 8am – 5pm

Eden Prairie

6385 Old Shady Oak Rd., Suite #250

Eden Prairie, MN 55344

Open hours Mon-Fri 8am – 5pm

Map & Directions

Forest Lake

56 E. Broadway Ave, Suite #102

Forest Lake, MN 55025

Open hours Mon-Fri 8am – 5pm

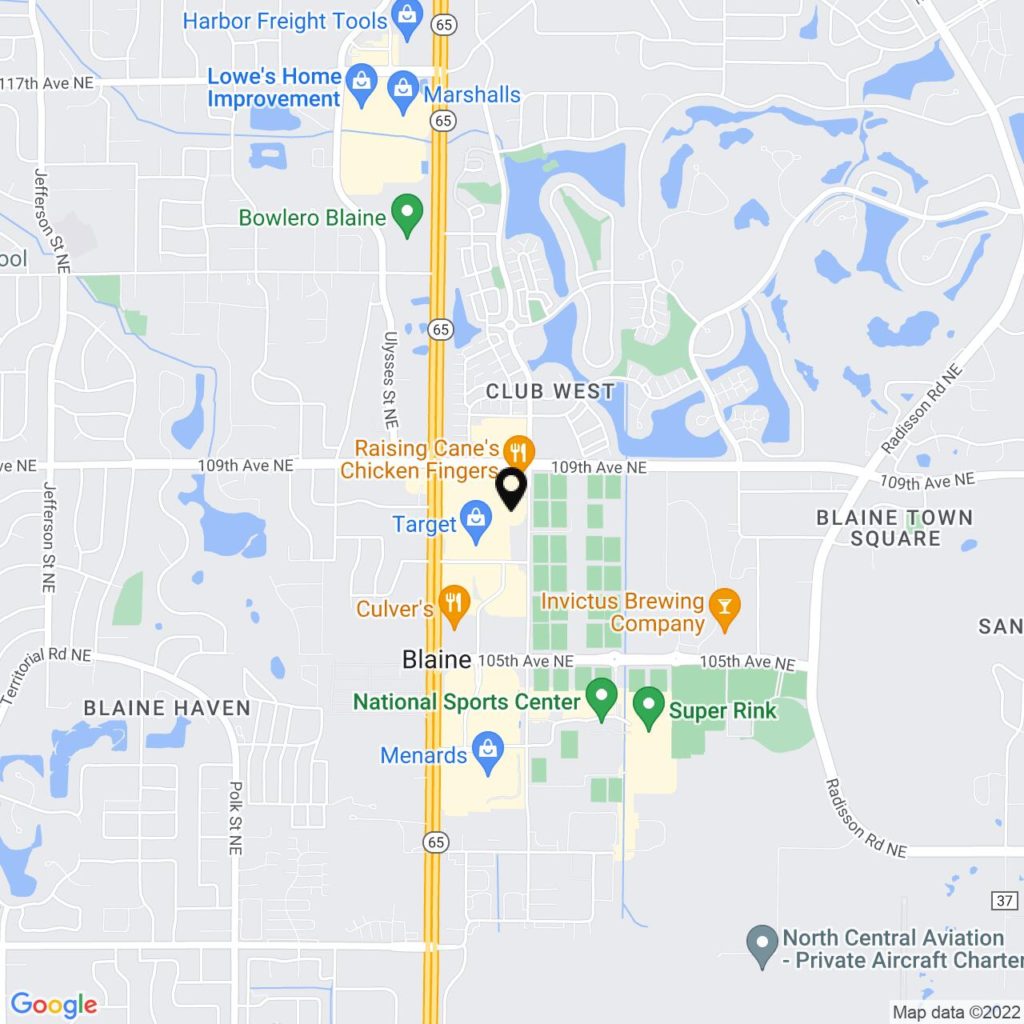

Maple Grove

11670 Fountains Drive, Suite #200

Maple Grove, MN 55369

Open hours Mon-Fri 8am – 5pm

Map & Directions

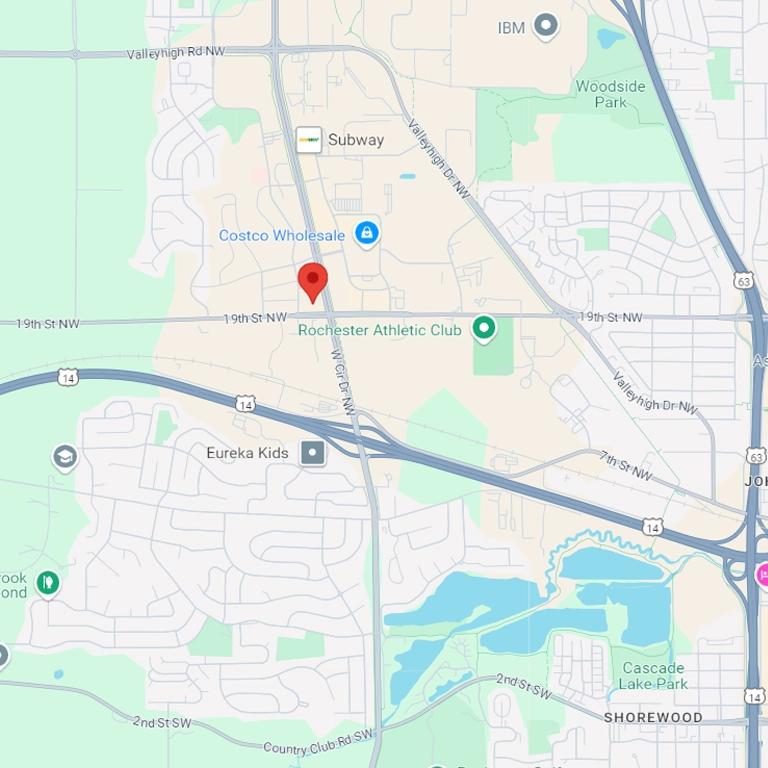

Rochester

2048 Superior Drive NW

Rochester, MN 55901

Open hours Mon-Fri 8am – 5pm

Map & Directions

Roseville

2355 Highway 36 West, Suite #400

Roseville, MN 55113

Open hours Mon-Fri 8am – 5pm

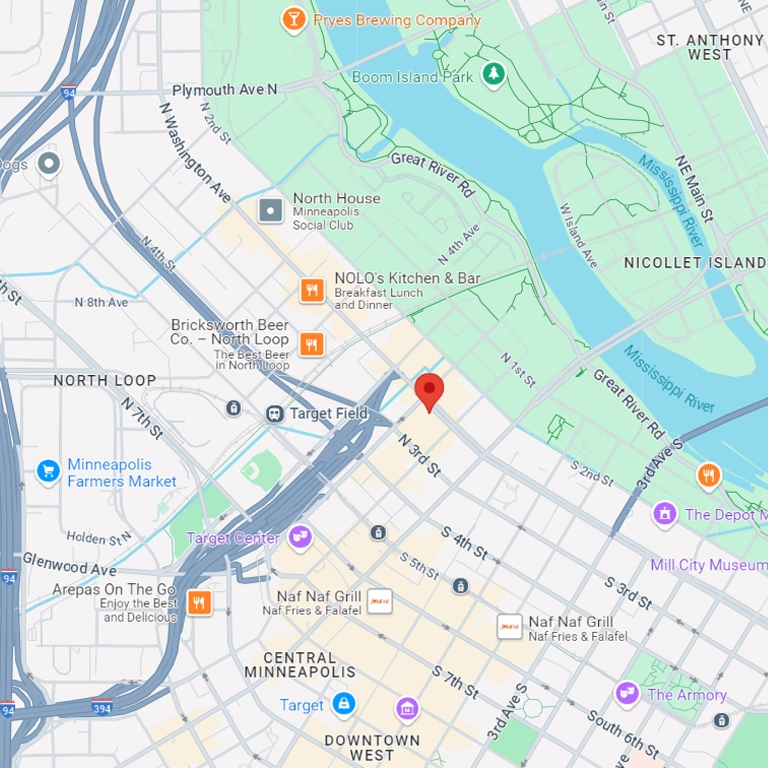

St. Paul

445 Minnesota Street, Suite #1500

St. Paul, MN 55101

Open hours Mon-Fri 8am – 5pm

Wayzata

1155 East Wayzata Blvd, Suite #10

Wayzata, MN 55391

Open hours Mon-Fri 8am – 5pm

Woodbury

7377 Currell Blvd., Suite #101

Woodbury, MN 55125

Open hours Mon-Fri 8am – 5pm

The information on this website is for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation. This information is not intended to create, and receipt or viewing does not constitute, an attorney-client relationship.

Your privacy is important to us. Please review our Privacy Policy for more information.

© 2024 All Rights Reserved.