Divorce almost always means that both spouses need to do some substantial financial rearranging. Whereas couples used to have two people to contribute to the utilities, housing expenses, and child expenses, after divorce, the spouses will each have to figure out how to pay the bills and meet expenses on just one income. Spousal maintenance, also known as alimony, is often an important issue in many divorces, as a result. Spousal maintenance is designed to help a financially disadvantaged spouse make ends meet even after the divorce. In December 2017, President Trump passed the Tax Cuts and Jobs Act which made wide-ranging changes to many elements of the federal tax code. One of those changes came in the area of spousal maintenance.

Divorce almost always means that both spouses need to do some substantial financial rearranging. Whereas couples used to have two people to contribute to the utilities, housing expenses, and child expenses, after divorce, the spouses will each have to figure out how to pay the bills and meet expenses on just one income. Spousal maintenance, also known as alimony, is often an important issue in many divorces, as a result. Spousal maintenance is designed to help a financially disadvantaged spouse make ends meet even after the divorce. In December 2017, President Trump passed the Tax Cuts and Jobs Act which made wide-ranging changes to many elements of the federal tax code. One of those changes came in the area of spousal maintenance.

In the past, spousal maintenance was tax-deductible to the spouse paying support. In addition, spousal maintenance was taxed as income for the spouse who was receiving support. The new tax law makes drastic changes. Under the new law, for any divorce after December 31, 2018, spousal maintenance is no longer tax deductible for the paying spouse. The spousal maintenance will also not be taxed as income to the receiving spouse.

The new act also discusses potential modifications. For any spousal maintenance order that is modified after December 31, 2018, the new law concerning spousal maintenance deductions will only apply if the new modification agreement or order specifically provides that the new tax law applies. In other words, parties considering modifying prior spousal maintenance can likely still rely upon the incentives contained in the former tax code.

There may be a rush to get divorced before the end of 2018, especially for those parties who prefer the deductibility of spousal maintenance. The new law will also likely have an impact on divorce settlements. Up until now, a spouse paying support had at least a minor incentive to agree to pay spousal maintenance because he or she could deduct those payments on federal taxes. Now that the incentive is being removed, it may be more difficult for parties to reach an amicable settlement at mediation before a divorce trial.

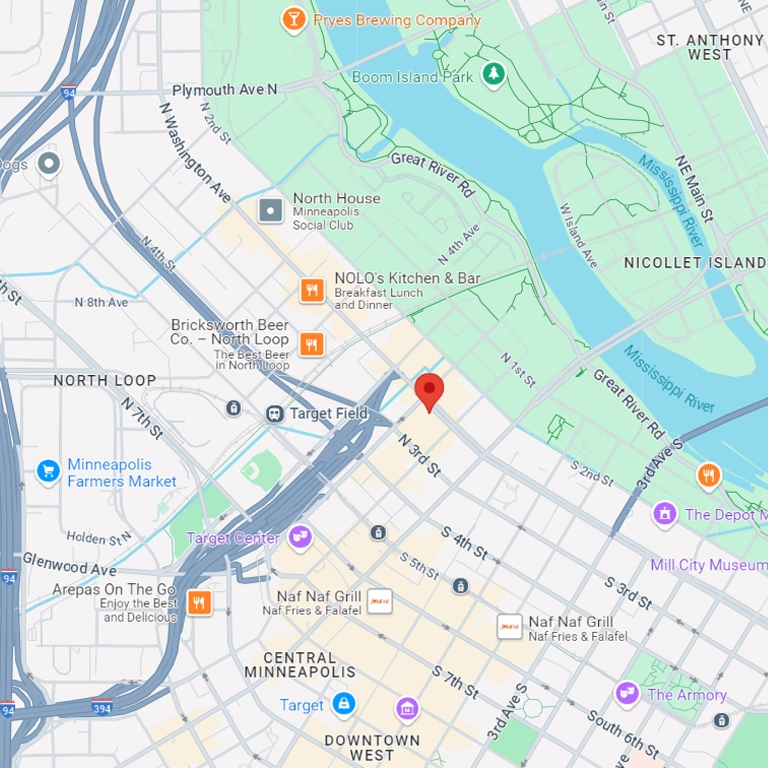

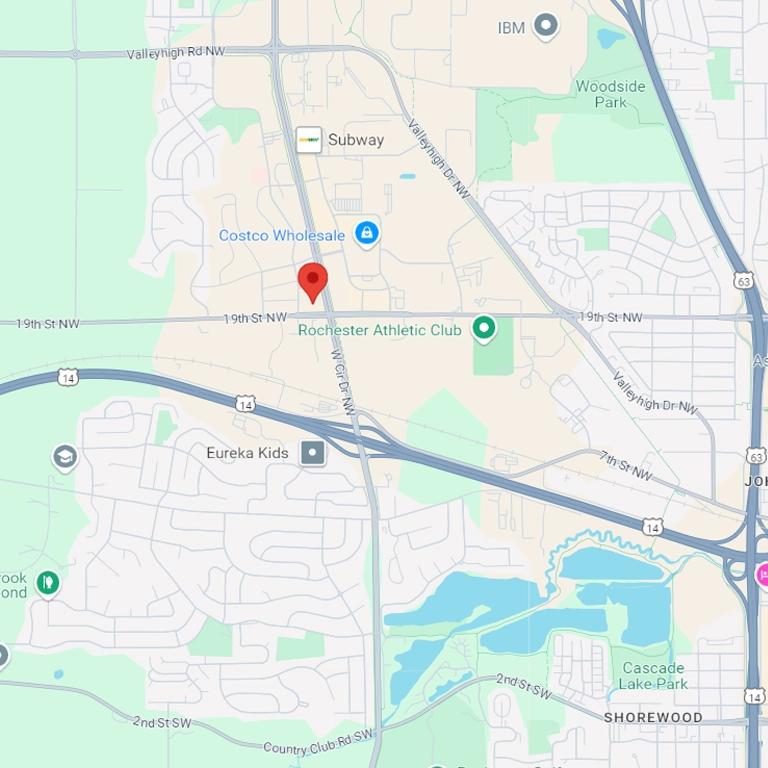

We have extensive experience with helping our clients with spousal maintenance and all issues of divorce. Call us today at (320) 299-4249 for a consultation and we can talk about your case and what we can do to help you.