In the United States, consumer debt has topped four trillion dollars. Almost ten percent of Americans carry such significant credit card debt that they do not believe they will ever pay off their credit card debts completely. Moreover, credit card debt usually only represents a portion of the debt owed by American households, as most households carry other types of debt, such as mortgages, student loans, or other unsecured debt, such as medical debt. It is common for people to loan their friends and family members money. While usually the creditor and debtor can work out terms and get the debt paid off in a reasonable time, there are some cases when the debtor passes away while the debt is still outstanding. If you were owed a debt when the debtor died, you need to understand the process to try to get paid.

In the United States, consumer debt has topped four trillion dollars. Almost ten percent of Americans carry such significant credit card debt that they do not believe they will ever pay off their credit card debts completely. Moreover, credit card debt usually only represents a portion of the debt owed by American households, as most households carry other types of debt, such as mortgages, student loans, or other unsecured debt, such as medical debt. It is common for people to loan their friends and family members money. While usually the creditor and debtor can work out terms and get the debt paid off in a reasonable time, there are some cases when the debtor passes away while the debt is still outstanding. If you were owed a debt when the debtor died, you need to understand the process to try to get paid.

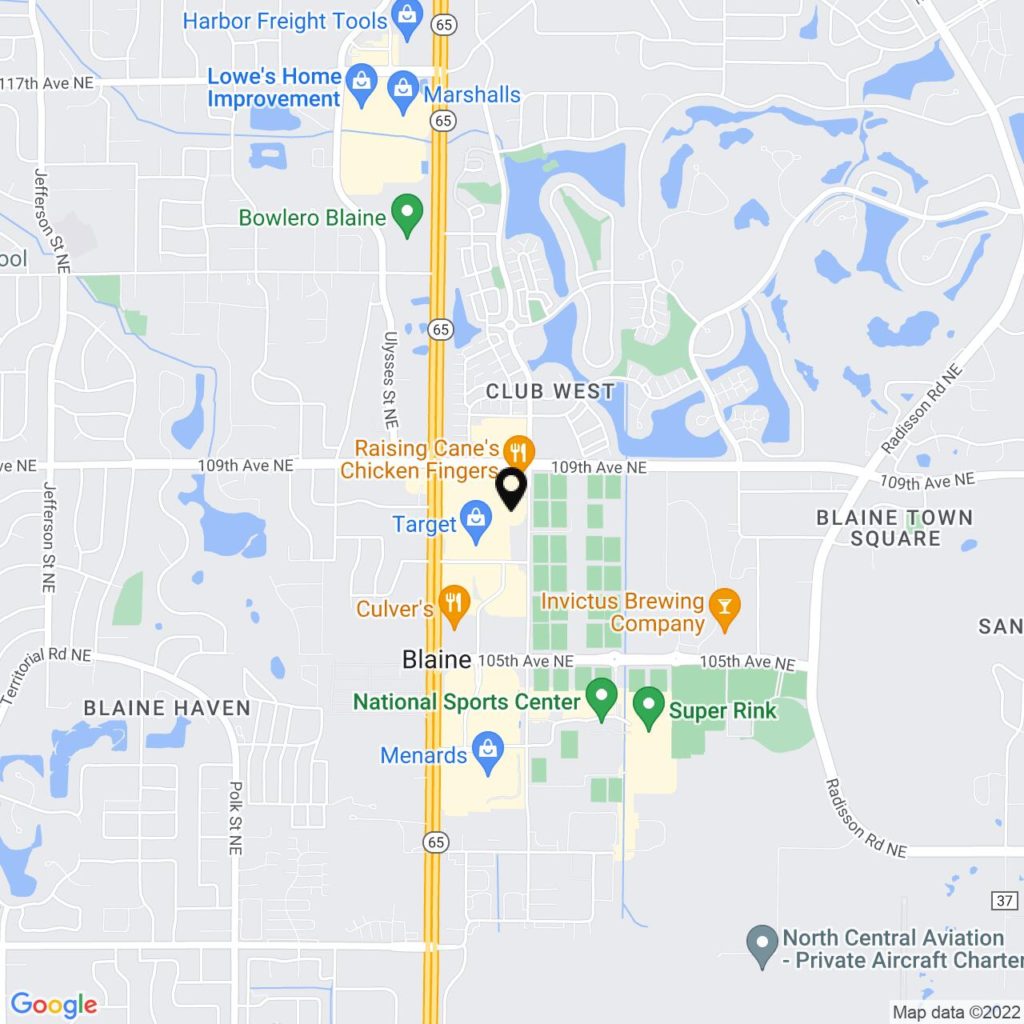

Under Minnesota statute 524.3-803, if you are owed money by someone who passes away, you have a limited amount of time to provide official notice of the debt. As the creditor, you are responsible for filing a claim with the estate. The personal representative will then review your claim and decide if your claim is an allowable debt. If the debt is allowable and valid, the debt will be put in a particular order of priority. Under Minnesota law, certain debts enjoy priority over others. In other words, some debts will get paid before others, regardless of the order in which their claim was filed. For example, a claim by the medical care provider to recoup a debt for treatment for medical needs just before the decedent’s death will enjoy higher priority and get paid before a credit card debt.

Creditors also need to understand that Minnesota law provides that the decedent’s family members are not and cannot be held responsible for the debts of the decedent unless they are also named on the debt. This means that although you know the decedent’s son or daughter has the money to pay off the debt owed by the decedent, you cannot proceed to collect the debt against those people unless they also signed on the debt.

Let us help you understand your rights and responsibilities regarding debt and probate. Call us at (320) 299-4249 for a consultation.