Are you wondering if bankruptcy is the right option for you? Click here for six telltale signs you need to file for bankruptcy.

COVID-19 has wreaked havoc on the entire world’s economy. Cumulative job losses reached 23 million as of May 2021. That’s just in the United States.

All over the world, people and families have had their lives disrupted in ways none of us could have ever predicted. Many have lost their jobs, their homes, their families, even their marriages. Most of all, many have lost the stability that makes so much of modern life possible.

If you’re one of those that life’s thrown at curveball at, you may be thinking of filing for bankruptcy. Personal bankruptcy cases have been on the rise in 2022, peaking in the spring.

Keep reading if you’re ready to find out how beginning your own bankruptcy case can get you out of whatever financial straits you might be in.

1. You’ve Suffered Financial Setbacks

You certainly wouldn’t be alone. These past few years have put financial strains on nearly everybody that none of us could have ever predicted.

You might have lost your job, perhaps due to COVID-19 or some other circumstance. You or someone you love may have experienced medical expenses which could have put your finances into a tailspin, as well.

Or maybe you’ve been living off credit as so many have had to do during the pandemic. Or you’re going through a separation and are finding your finances suddenly cut in half.

These are just a few of the virtually endless reasons someone could be experiencing financial instability in 2022. If any of that resonates, you might want to think about filing for bankruptcy. Once you have your head back above water, you’ll be able to think clearly.

2. You’ve Depleted Your Savings

Many have had to survive off their savings during the pandemic. No matter how much of a nest egg you might happen to be working with, those numbers dwindle drastically when it’s your only income. Especially in the case of soaring inflation and the cost of living going up, everywhere you look.

If you’ve depleted all of your savings and are starting to fall behind on bills and expenses, it could be a sign that it’s time to file for bankruptcy.

3. You’re Relying on Loans to Pay Bills

Relying on loans to pay for your current bills isn’t uncommon. It’s also not at all sustainable. You’ll just be digging yourself in deeper and delaying the inevitable.

This counts for all loans, as well. It goes for withdrawing cash from your credit card. It also goes for services like payday loans.

Either of those scenarios will have exorbitantly high interest rates that are just going to dig you deeper into debt. If you’re having to juggle finances constantly, you’re going to eventually drop the ball. Filing for bankruptcy offers you the opportunity to start over with a clean slate.

4. You’ve Defaulted on a Loan

Defaulting on loans is not a good sign. For one thing, it takes a drastic toll on your credit score. For another, it also establishes a pattern.

Eventually, you need to see the writing on the wall.

Defaulting on loans is especially a sign of being ready for bankruptcy for small or minor bills like monthly credit card payments. Not being able to keep up with a minimum payment of $20 or $30 does not bode well for the rest of your financial affairs.

5. You’ve Lost a Lawsuit

If creditors are pursuing you for money owed and winning, it’s a sign of what’s to come. Once creditors are taking legal measures, it’s the beginning of a more serious campaign.

Once this has begun, the next step is to start seizing your assets such as your bank account or any valuable belongings you might own.

Filing for bankruptcy can put an immediate halt to many civil lawsuits. As soon as the motion is filed, creditors will no longer be able to pursue your assets. It also prevents them from seeking punitive damages.

If you’re thinking of filing bankruptcy to avoid a civil lawsuit, it’s important to know the difference between the different types of bankruptcy.

Generally speaking, bankruptcy will resolve:

- Credit card debt

- Home foreclosure

- Contract disputes

- Business partner disputes

- Personal injury cases

- Debt collections

Bankruptcy will not halt child support payments or divorce agreements, however. It’s important to know what bankruptcy can and cannot do when you’re deciding if it’s the right course of action for you.

6. Your Mental Health Is Suffering

Debt and financial problems can often destroy your entire life. Constantly having to worry about your finances can send you into severe panic and anxiety spirals. Not being able to live up to your obligations can lead to severe depression.

The toll on your mental health is one of the greatest prices of living with debt. If left unchecked for long enough, it can suck all the joy out of your life.

When your mental health suffers, every other aspect of your life suffers as well. It can take a toll on your personal relationships if you’re not feeling your best. You’re not as able to be as present for the people you love and care about. You’re not able to be as much of a reliable partner or parent.

If you’re feeling any of these things, it’s a good sign that filing for bankruptcy is the right course of action. It will let you start over, giving you a fresh start and a clean state to begin building the life of your dreams.

Are You Looking for Bankruptcy Services?

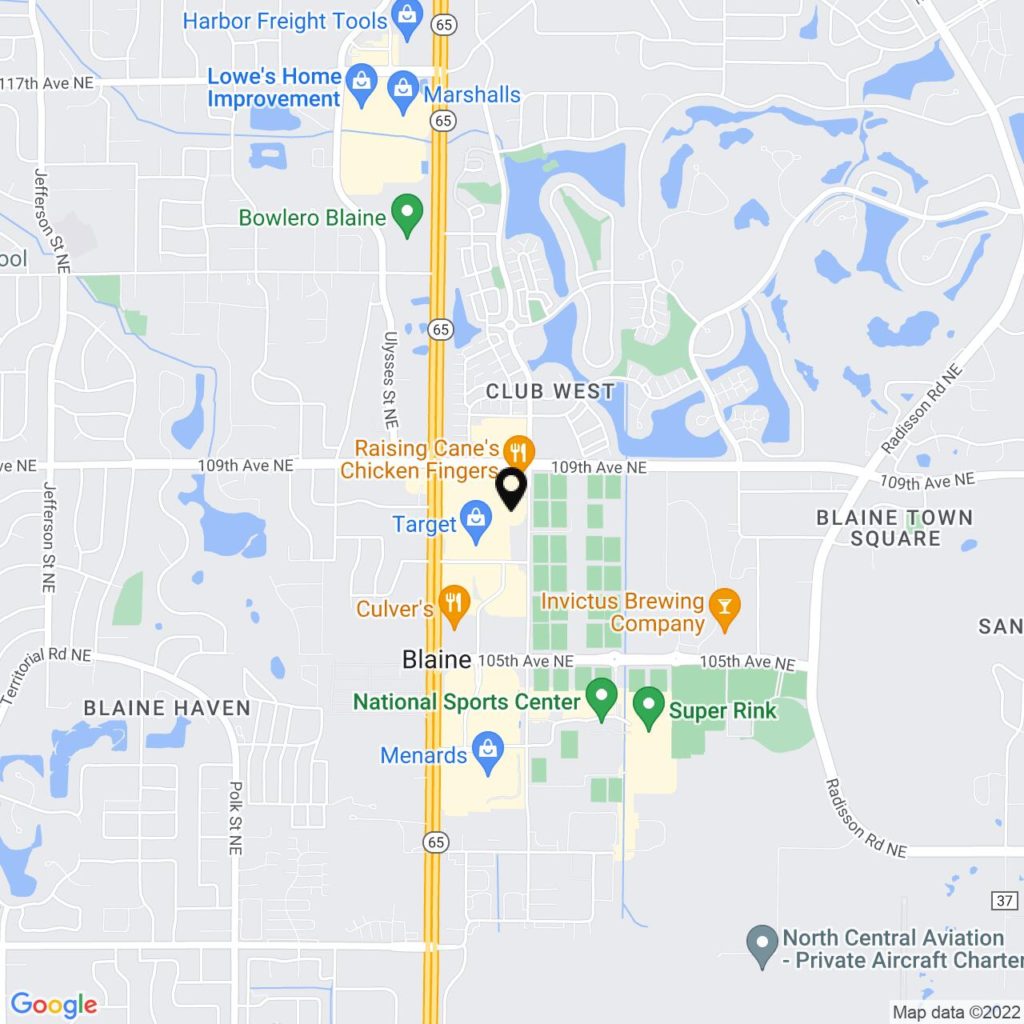

We are here for you! We understand that moments like bankruptcy or divorce are some of the most upsetting and unsettling things that can happen to someone. When they do, you need an advocate in your corner.

At Johnson/Turner Legal, we’d love to be that advocate. Contact us today and let us know how we can help you end your troubles!