Is it possible to avoid probate in Minnesota? Yes! Discover more about the probate process and the different ways to avoid it.

The loss of a loved one is always difficult. While grieving is important, it can be interrupted by myriad other responsibilities including making funeral, memorial, and burial plans. It also means taking steps to settle the deceased’s estate, which often requires a process known as probate.

Many people wonder what this entails and if there are ways to avoid probate in Minnesota. The short answer is, it depends.

Different circumstances require probate, while others allow you to forgo the process. The important thing is understanding what these are so that you can know how to move forward.

This article covers the basics of probate in Minnesota, including details about the procedures. It also includes scenarios when probate is required and situations where it can be avoided. Keep reading to find out more.

What Is Probate?

Probate is the legal process of reviewing and assigning the inheritance assets of a deceased person. This includes validating the last will and testament, and its contents. It can entail determining lines of succession if that is something that is not specified in the will.

In most locations, probate is handled by a specific set of probate courts. The role of the court is to validate the will of the deceased (if one exists). It also must ensure all debts and taxes are paid, and allocate inheritance to heirs or other individuals specified in the will.

The probate process can take many months or even years, depending on the circumstances surrounding the case. Whether probate is required depends on many factors, including the jurisdiction and the circumstances surrounding the inheritance.

What Does the Probate Process Entail?

Probate involves filing an application or petition with the appropriate court. This is typically in the country where the deceased person lived or owned property.

The application must have various statements and details, including information about the deceased and the applicant’s interest in the proceeding. The registrar can choose to accept or reject the application based on these requirements. (Note that a rejection does not mean probate is not required.)

After approving the petition the court appoints a personal representative or executor. This is usually a family member or someone else designated in the will.

This person then notifies all creditors and beneficiaries of their involvement in the settlement of the estate. This must be accomplished during a specified period of time.

The executor also is responsible for having all property and assets appraised. This is important for determining the value of assets but also for putting together an inventory for the court.

After this is completed, the personal representative must pay all outstanding debts left by the deceased. This includes all funeral expenses. They also must pay all taxes owed, including any estate taxes.

Next, the executor distributes the remaining assets to beneficiaries. In some cases, these individuals must pay an inheritance tax, although this is usually not part of the probate process.

Once these steps are completed, the estate may be closed. This involves a specific filing with the court and an official ruling. This releases the personal representative from any further obligations.

Informal vs. Formal Probate

In Minnesota, probate processes can be either informal or formal. With informal probate, the personal representative pays all outstanding debts and taxes without the supervision of the court. In general, this is in situations where circumstances are clear-cut, such as allocation being specified in the will.

In formal probate, the petitioner must appear before the probate court for a hearing. The court will ultimately determine how debts are settled and in which order, as well as the allocation of remaining assets. You are not required to hire an attorney for formal probate, but there are some very good reasons to do so.

When You Can and Cannot Avoid Probate in Minnesota

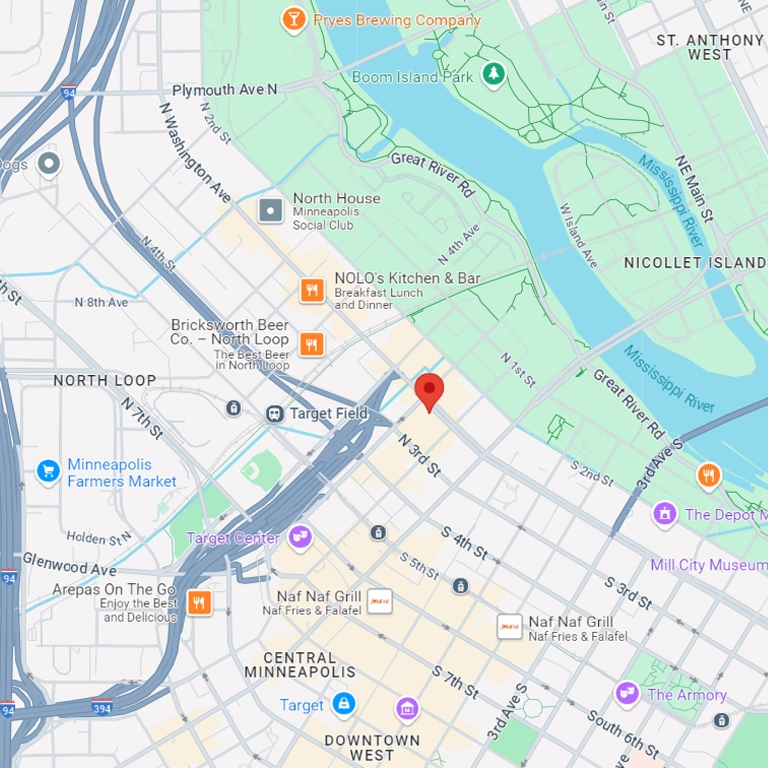

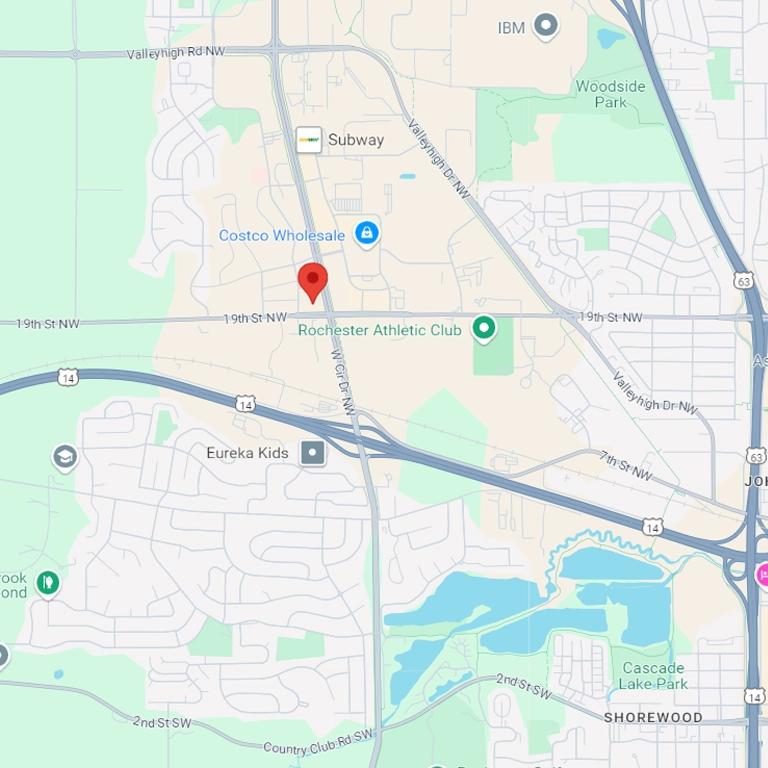

Minnesota probate applies to deceased persons who were residents when they died, different to an attorney in Wisconsin. It can also apply to non-residents who own real property in the state.

The first thing to note is that having a will by itself does not allow you to avoid probate. Three factors influence this determination: the amount of property; the type of property; and whether it was owned by one person or many.

First, if the estate is worth less than $75,000, heirs can collect inheritance without probate. If the estate is worth more, then probate is required (unless other circumstances described below come into play).

Benefits from life insurance policies or other payable-on-death accounts do not require probate. By their nature, they include a designated beneficiary.

One of the most popular estate planning options where probate is not needed is joint tenancy. This is where two or more people owned the property with undivided interest.

At the time of one owner’s death, the interest simply passes to the other co-owners. This includes bank accounts as well as real property.

The same is true of assets allocated to a trust since such resources are not technically part of an estate. They are the property of trustees.

In most other circumstances, probate is required to determine how assets should be allocated. An experienced attorney can help you make these determinations at the outset and assist you throughout the probate process if it is necessary.

Find a Minnesota Probate Attorney

Now that you understand the circumstances that allow you to avoid probate, you can know how to proceed with your situation. Hiring an experienced attorney can not only ensure that the process of estate settlement is handled correctly, but it allows you to forego the hassle.

At Johnson/Turner, we are committed to proving the best legal services to our clients, including navigating the Minnesota probate process. With each case, we assign an experienced probate attorney, two paralegals, a client engagement specialist, and a life coach. Reach out to us today to schedule a free consultation today.