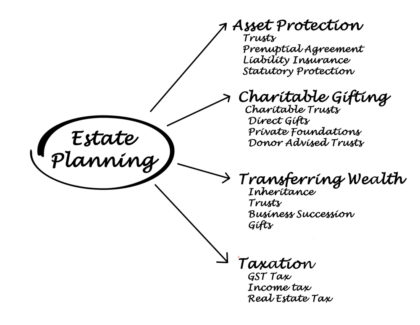

Accruing sufficient wealth and financial stability to be able to share that with our friends and family is very rewarding. Making sure that our loved ones can enjoy the same lifestyle and financial strength as we can help them attain is a worthwhile pursuit and gratifying for everyone. Making these financial gifts, while fun, need to be considered in a larger context. Your estate plan should be kept in mind while you decide how much you are about to give and to whom.

Accruing sufficient wealth and financial stability to be able to share that with our friends and family is very rewarding. Making sure that our loved ones can enjoy the same lifestyle and financial strength as we can help them attain is a worthwhile pursuit and gratifying for everyone. Making these financial gifts, while fun, need to be considered in a larger context. Your estate plan should be kept in mind while you decide how much you are about to give and to whom.

The thing that most people think about is taxes, and that is an essential component. As you probably know, the federal tax code underwent a major overhaul in late 2017. Some of these changes included the limits on gifts given to heirs and beneficiaries. Under the new tax code, an individual can give up to $5.6 million dollars to beneficiaries without being concerned about federal estate or gift taxes. In addition, a married couple can give up to $11.2 million and still be shielded from the federal estate tax. As the years go by, the limit will be raised to keep up with inflation.

In addition to giving funds in your will, you may want to also consider giving gifts during your lifetime. You can give up to $15,000 dollars a year to as many people as you want. In other words, you can give $15,000 a year each to all of your friends and family members without being concerned about cutting into the gift and estate tax exemption. A married couple can give up to $30,000 a year per recipient.

Estate plans should also take into account the identity of the person receiving the gift. It is common for people to want to help their favorite charitable institutions by making frequent and sizable donations. Unlike individuals, charities are exempt from paying gift taxes at all. Moreover, the gift is deductible to you, within certain parameters. Giving assets to a charity will also reduce the size of your estate at the time of your death, making it less likely that estate taxes will be assessed against you or your estate.

If you want to make financial gifts to your loved ones, make sure it fits in your estate plan. Call us today at (320) 299-4249 for an appointment.