We all keep an eye toward the future even when working on our goals today. Trying to ensure the future stability of our family is an important objective, and there are many steps on  the way to achieving that objective. Smart money management, wise investments, and estate planning are all critical when building a strong future for you and your family. The tools that are used in an estate plan can vary wildly depending on the assets, goals, and chosen beneficiaries. Trusts can be an excellent tool to include in your estate plan. Naming a trust as beneficiary can be a good choice for your estate plan.

the way to achieving that objective. Smart money management, wise investments, and estate planning are all critical when building a strong future for you and your family. The tools that are used in an estate plan can vary wildly depending on the assets, goals, and chosen beneficiaries. Trusts can be an excellent tool to include in your estate plan. Naming a trust as beneficiary can be a good choice for your estate plan.

Several different types of assets may require that you name a beneficiary. IRAs, life insurance policies, and retirement accounts will all need you to choose a beneficiary. One option is to name a particular person outright, such as your spouse or your adult child. If you choose that option, at the time of disbursement of the funds in the account, the funds will pass directly to that beneficiary without having to pass through probate. This has the major advantage of allowing your selected beneficiary to access the funds much faster. The big downside of such a choice is that you would retain no control over how those funds are used.

Naming a trust as a beneficiary means that the funds are paid directly into the trust account. You will name a particular trustee. The trustee’s responsibility is to properly manage the assets in the trust and to only make disbursements according to your specific instructions. For example, you can direct that the trustee can only make disbursements for the purpose of funding your niece’s college education or to pay property taxes on real estate owned by your family business.

There are several situations when you may want to consider naming a trust as beneficiary instead of naming a particular individual or individuals. One of the most common situations is when your children are still very young. Minor children cannot directly take control over their inheritance. Naming a trust as beneficiary allows you to make sure their financial future is taken care of by your chosen trustee until they reach the age of majority. Another common situation is if you want to leave assets to help a family member or loved one who has special needs. Leaving a large amount of assets to that person could mean they are no longer eligible for certain needs-based programs, such as Medicaid. Naming a trust as beneficiary can allow you to provide them with financial support while still not interfering with needs-based eligibility.

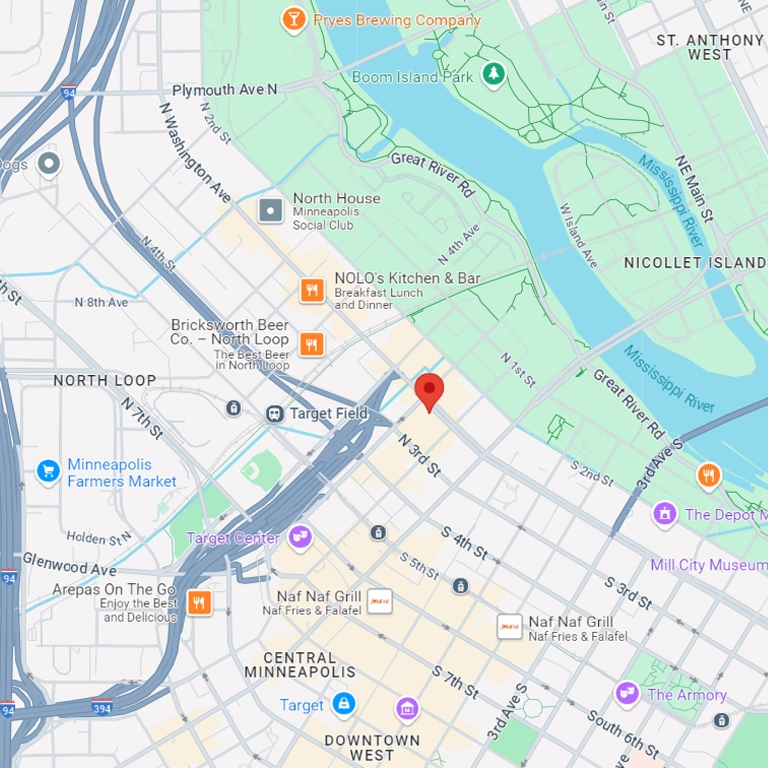

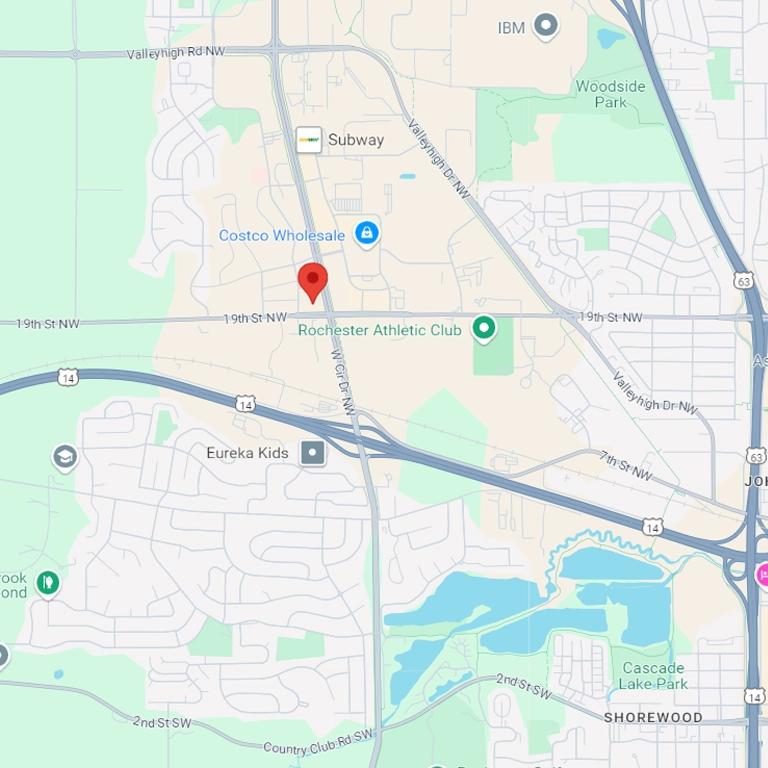

We are familiar with all estate planning. Call us at (320) 299-4249 or a consultation to talk about your family, your goals, and how we can help.