Do you want to know what the laws are for the elderly? Read this guide to discover everything you need to know about elder law!

Going through the aging process offers a unique set of challenges. It affects our physical, mental, and even financial health. Families of senior citizens have a lot of ins and outs to navigate when arranging for their loved ones in this age group.

In particular, you and your family might need a deeper understanding of elder law. If that’s true, you’re in luck. This article will be your complete guide to legal issues concerning the elderly.

Elder law can concern many kinds of legal matters. Keep reading to ensure that you and your loved ones are informed on the best steps forward in caring for the elderly.

Introduction to Elder Law

This legal practice area specifically deals with the issues and challenges faced by older adults and their families. It covers a broad range of topics. These might include estate planning, Medicaid planning, guardianship and conservatorship, and more.

Elder Law is important for all seniors and their families, even if you already think everything’s under control. That’s because it provides a way for them to plan for and address the unique challenges that come with aging.

Consider working with an elder law attorney. In doing so, you can ensure that your legal and financial affairs are in order. Plus, you’ll have the necessary protections and support in place as they navigate the challenges of aging.

This type of planning can give seniors and their families peace of mind. It ensures that they are able to age with dignity, security, and independence.

The Basics of Estate Planning

This first facet of elder law is perhaps the most desirable matter to settle for many families. Estate planning involves making arrangements for the distribution of a person’s assets and property after death.

A will is a legal document that should specifically be a part of any estate planning process. It outlines a person’s wishes for the distribution of their assets and property. It also notes the appointment of an executor to manage the estate.

Wills are a crucial part of estate planning. They provide a clear and legally binding way to ensure that a person’s assets are distributed according to their wishes.

It’s important to note that without a will, state law will dictate how this is done. These may not align with their wishes or those of their family.

Trusts are another important estate planning tool. These are legal entities that hold assets on behalf of the trust maker. They provide specific instructions for the distribution of these assets.

These details make it important to seek professional legal guidance on elder law. This is of particular value if special circumstances surround your case. Examples might be if your loved one filed for bankruptcy or has overseas assets.

Power of Attorney

Consider another important aspect of estate planning. Power of Attorney allows a person to appoint another person to manage their affairs if they become incapacitated.

There are two types of powers of attorney: medical power of attorney and durable power of attorney. A medical power of attorney allows a person to appoint someone to make medical decisions on their behalf. A durable power of attorney gives someone the power to manage a person’s financial affairs if they are unable to do so.

Take the time to talk with your loved one about these options if you think it might help everyone in the dynamic. In most cases, it’s wise to seek professional legal guidance on the matter. Family law experts could be of service here.

Perhaps this is one reason why the legal services industry throughout the world is so successful. Families would otherwise struggle with handling healthcare, assets, and everything else concerning their elderly loved ones. In 2021, the global market was valued at over $901 billion.

Consider Their Medical Needs

When it comes to healthcare options for seniors, you have options. Medicare and Medicaid are two of the most important programs to consider.

Medicare is a federal health insurance program. It’s for people who are 65 years of age or older. It’s also ideal for people with certain disabilities.

Medicaid, on the other hand, is a joint federal and state program. This healthcare option provides medical coverage for low-income individuals and families.

In addition to these programs, seniors may also consider Medicare Supplement plans. These are also known as Medigap plans. They provide additional coverage to fill gaps in the Medicare program.

Medicare Advantage plans are another option that provides an alternative way to receive Medicare benefits. They typically offer a broader range of coverage. It might include prescription drugs, dental and vision care, and sometimes even hearing services.

Guardianship and Conservatorship

There are two legal arrangements that provide someone with the authority to make decisions for another person who is unable to do so. Those arrangements are called guardianship and conservatorship.

Guardianship refers to the appointment of someone to make decisions regarding the personal care of an individual. This might be about where they will live and what medical treatment they will receive.

A guardian is responsible for ensuring that the individual under their care has their basic needs met. This involves basic needs such as food, clothing, and shelter. It could also mean overseeing their medical care and making decisions about their living arrangements.

Conservatorship, on the other hand, has to do with a person’s financial affairs and property. The process of obtaining either guardianship or conservatorship involves a court proceeding.

A conservator is responsible for managing the financial affairs of the individual under their care. They’ll have to be paying bills, manage their investments, and ensure that their financial needs are met.

Both can be complex and challenging responsibilities. It’s important for the appointed person to have a thorough understanding of their obligations.

Retirement and Financial Planning

This is another crucial aspect of Elder Law. It involves ensuring that seniors have sufficient financial resources. They should be able to support themselves during their retirement years.

Social Security is a key component of retirement planning. It provides a guaranteed source of income for retirees.

To maximize their Social Security benefits, it’s important for seniors to understand how their benefits are calculated and when to claim them. They should also know how to coordinate them with other sources of income.

Pensions are another important source of retirement income. It’s essential that seniors understand their options, as well as any restrictions or limitations on accessing these benefits.

Seek Legal Guidance You Can Trust

Now that you know more about elder law, perhaps you’re feeling more confident. You can move forward in ensuring your loved one has the care and support they need.

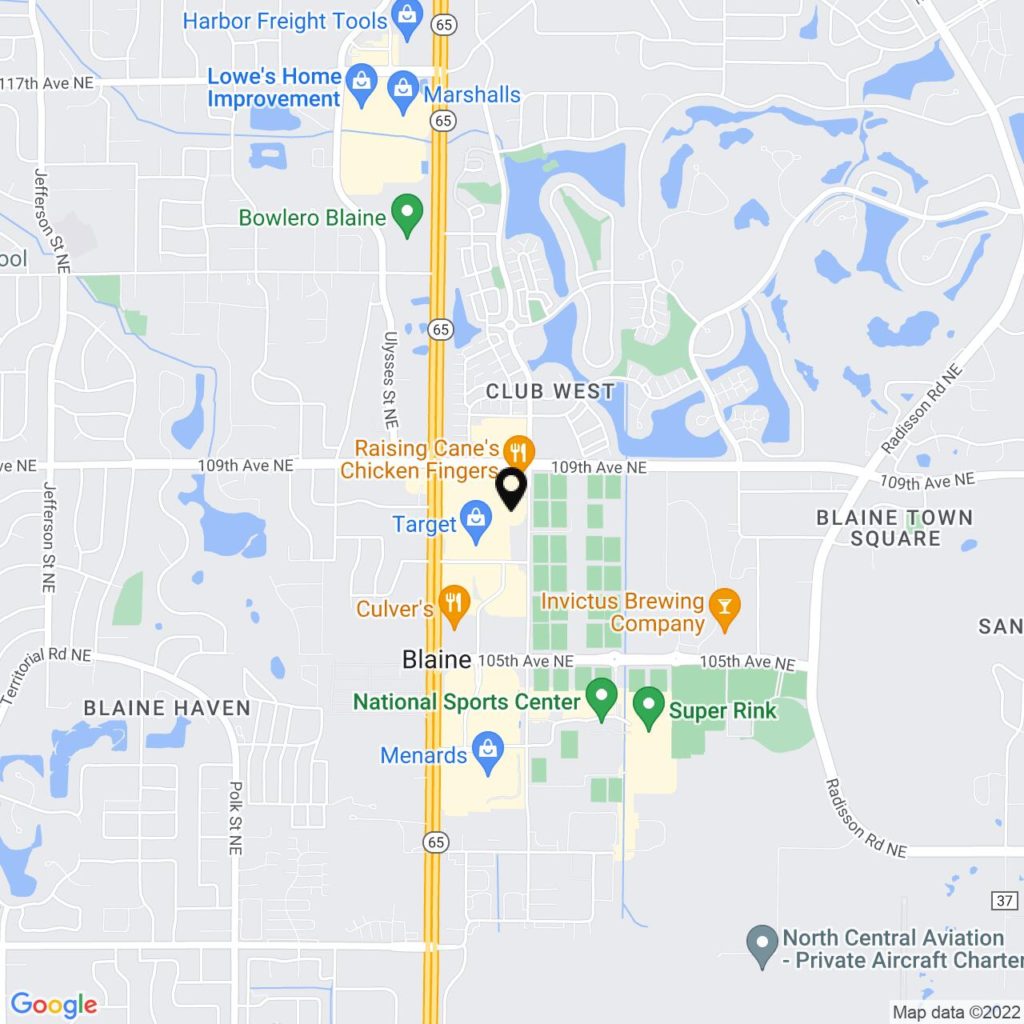

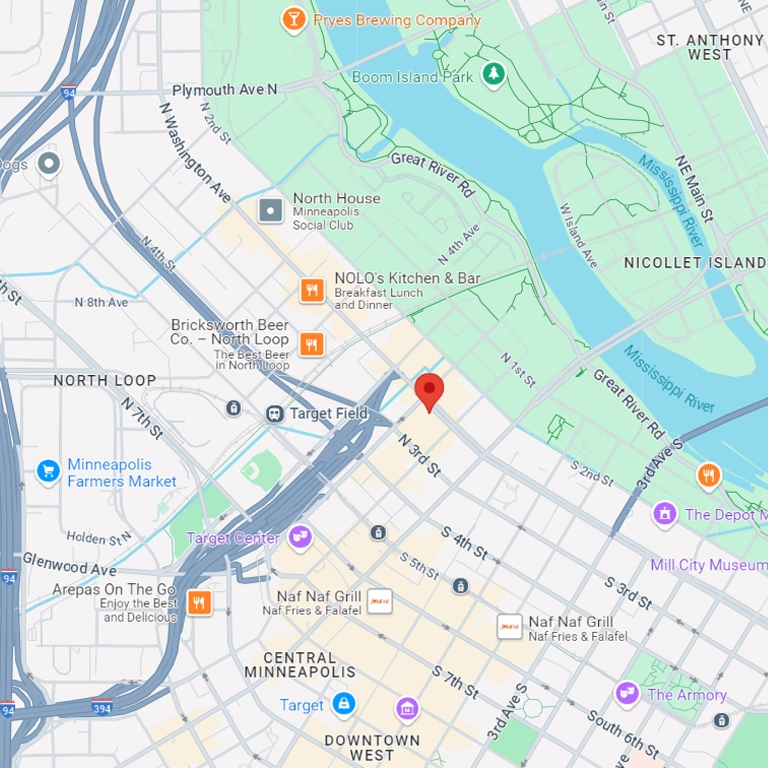

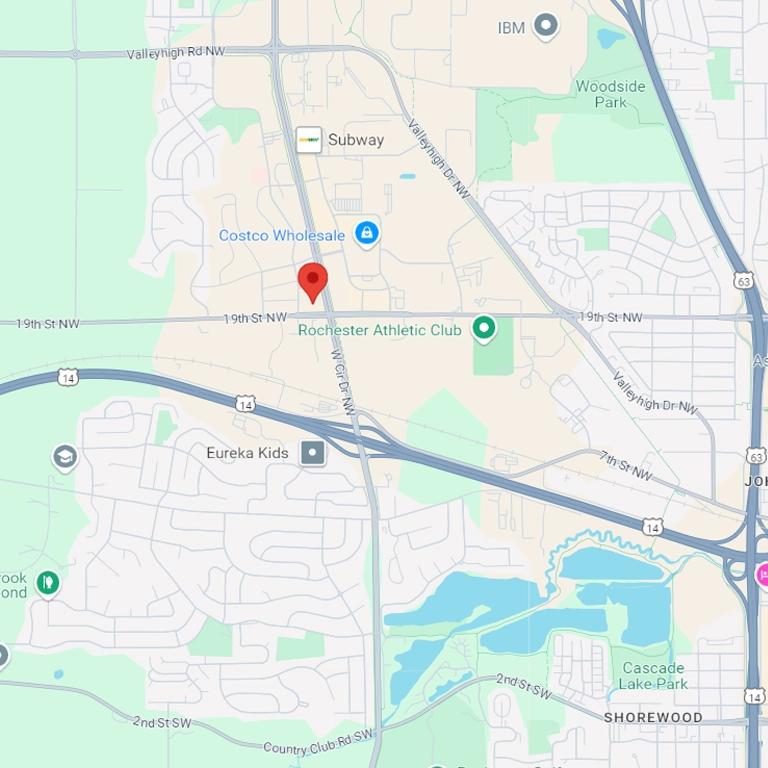

Still, if you’re feeling overwhelmed, we can help. The good news is that we only charge a flat fee for the sake of your family’s budgeting instead of an hourly rate.

We help families just like yours navigate legal institutions. For that reason, we hope you reach out to us at your convenience. To start, learn more about our guardianship attorney services.