There are a few hidden benefits that come with filing for bankruptcy. Read on for more information about declaring bankruptcy.

401,293 people filed for bankruptcy in 2021 alone. Many people think that filing for bankruptcy is always a bad thing, but this isn’t necessarily true. There are many hidden benefits of filing for bankruptcy that you may not know about.

Understanding the benefits of bankruptcy can help you make better decisions after you make the filing. But what are these hidden benefits and how can you reap them?

Keep reading and learn more about how you can benefit after filing for bankruptcy below.

You Won’t Have to Deal With Multiple Creditors

There are many misconceptions surrounding the concept of bankruptcy. But learning about bankruptcy basics can help you understand the reality of this concept. Many people think that if they file for bankruptcy, they will lose everything.

They may also think that doing this will ruin their credit forever. But neither of these aspects is true. While it is true that you may have to part with many of your assets, you won’t lose everything.

Your credit won’t be permanently ruined either. The main benefit of filing for bankruptcy is that you can get multiple creditors off your back. It can be stressful juggling several creditors who are all coming after the money you owe.

But once you file for bankruptcy, you will get an automatic stay. This means that it is no longer possible for your creditors to come after your debts. These creditors also cannot take any legal action against you as long as that automatic stay is in place.

The Details

Once you file for bankruptcy, you will no longer need to pay off the debts that you owe. This is because the debts will get discharged. The downside of this is that you will have to part with some of your more expensive assets.

This helps discharge your debts and satisfies the creditors. These debts may not need to be paid off entirely. The creditors may settle for a lesser amount of money than what you owe.

This is more likely if you don’t have many expensive assets to get rid of those debts. The upside is that this can dispel the stress of having several creditors coming after you. This gives you time to collect yourself and think about what you can do after the bankruptcy goes through.

It Is Possible to Keep Some Important Assets

Many people think that they will lose everything as soon as they file for bankruptcy. But this is not true. You will indeed have to part with several assets to get rid of the debt that you owe and satisfy the creditors.

But you don’t have to part with everything. Suppose you file for Chapter 13 bankruptcy. This type of bankruptcy makes it likely that you can keep several important assets.

These may include your car and your house. If your car falls under certain exemption laws, you may keep it as well. Each bankruptcy is different since it depends on the debt that you owe.

Chapter 13 bankruptcy is one of the more flexible forms of bankruptcy. It would be very unlikely to have to foreclose on your house or part with your car when you file for this type. Chapter 7 bankruptcy is different.

What You Need to Know

You will have to liquidate many of your important assets, but you still might be allowed to keep some of them. This is because certain assets fall under federal or state exemption laws. These laws would keep some of your valuables safe.

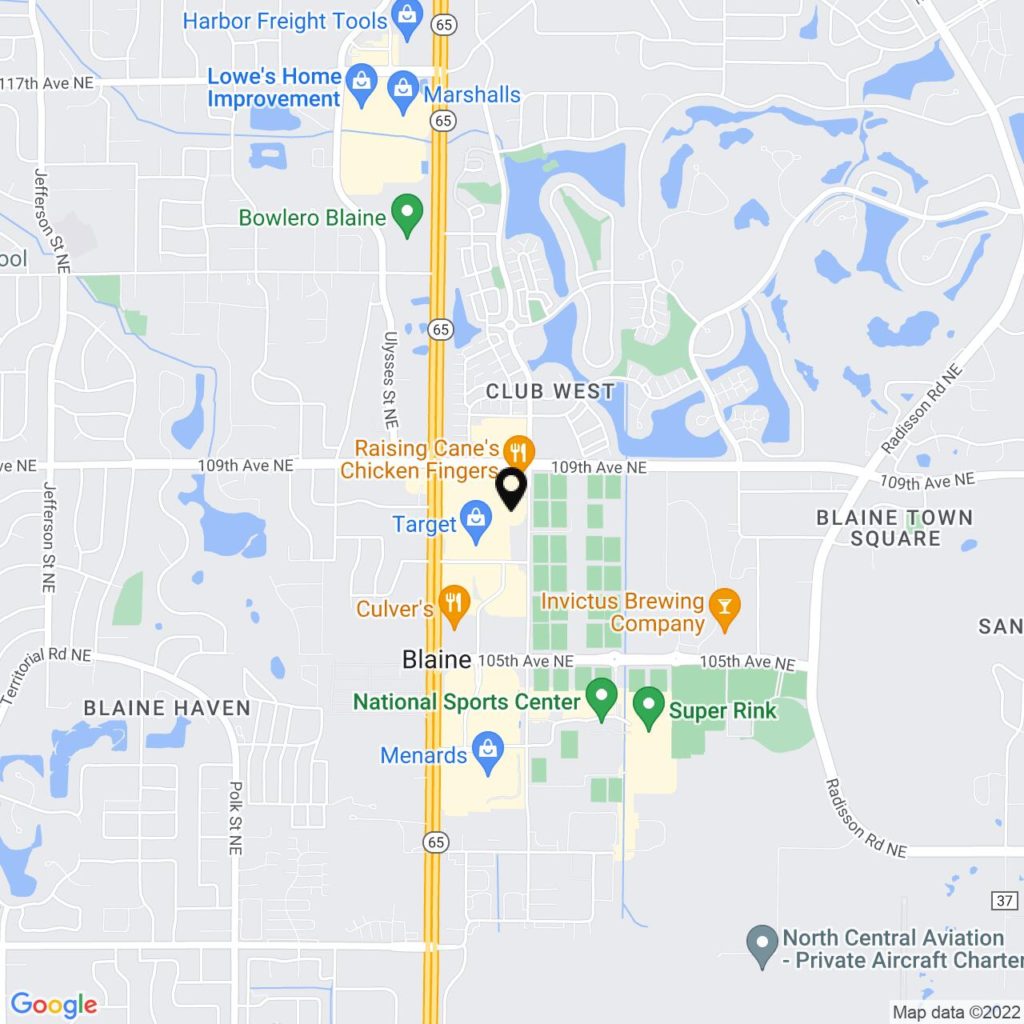

But these laws differ depending on where you live. If some of your assets do not fall under these exception laws, they may still be subject to liquidation. This is why it is important to be familiar with these laws before you file for bankruptcy.

If you don’t have a choice, you may have to part with some important items. But the upside is that you will never be left without anything. There will always be some assets that you should be allowed to keep.

Chapter 13 bankruptcy is also a useful type to file if you are worried about your house getting foreclosed. This type of bankruptcy can stop or delay this process so you can keep your house.

You Can Start Fresh

Many people think that filing for bankruptcy is the end of everything, but this is not true either. Many people file for bankruptcy because they want a fresh start. This is important because many people are constantly stressed due to all their debts.

Freeing yourself of those debts is very liberating. You can instead start thinking about other important things in your life. You can also stop worrying about creditors coming after you or taking legal action against you.

Filing for bankruptcy will solve all of these problems. While your credit score will take a hit from this filing, you can always build it up again over the years. You can then create a sturdier foundation for your finances.

This will help you avoid getting into too much debt again. You can also take a more proactive and positive approach toward your finances.

All About Filing for Bankruptcy

Many people don’t realize that there are many benefits they can enjoy after filing for bankruptcy. Doing this allows you to get a fresh start with your finances. You may also be allowed to keep some of your assets and avoid home foreclosure.

You also won’t have to deal with creditors anymore. This is a great way to give yourself a clean slate with your finances. To learn more about filing for bankruptcy, check out our services.