To Pay or Get Paid: Support Payments in Divorce

Will you pay or receive money from your ex on a monthly basis? Child support and spousal maintenance are a big deal in a divorce. Make sure yours gets handled right.

A divorce proceeding can order two types of financial support: child support and spousal maintenance. These obligations are determined very differently. They also have different tax implications and extend for varying lengths of time.

Child Support

Child support is made up of three components: basic support, medical support and childcare support.

Basic support is determined largely by state guidelines, which consider both parents’ incomes and the allocation of parenting time. If one parent is the primary parent, he or she will typically receive child support from the other parent. If both parents have approximately equal parenting time, and have approximately the same amount of income, then basic support would typically not be ordered. Conversely, if both parents have approximately equal parenting time, but one parent makes significantly more than the other parent, then the parent with the greater income will pay child support to the other parent.

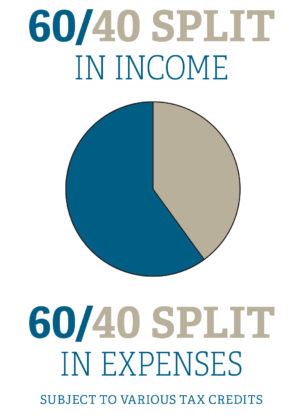

In addition to basic support, the court will also determine medical and childcare support. Regarding medical support, the court will expect the parents to pay the health insurance premiums and the uninsured health expenses in proportion to their income as a percentage of the parties’ combined income. In other words if one parent makes $60,000 and the other parent makes $40,000, they would pay 60% and 40% of the medical expenses, respectively.

Childcare expenses are treated similarly to medical expenses, except the person paying the childcare costs typically receives a tax credit. That tax credit is taken into account in determining the division of child care responsibility. In the example above in which the parties’ incomes were 60% and 40%, if one party spent $1,000 on childcare costs but received a $200 tax credit, then the remaining $800 would be divided based on the 60/40 split of costs.

Child support payments are paid with after-tax dollars. That is, the person paying child support does not deduct those payments from his or her income for the purpose of determining taxes, and the recipient of the child support does not have to pay taxes on the child support payments received.

Child support typically continues until the youngest minor child turns 18 and is no longer attending high school. Exceptions do apply to most of these rules. It is important that your attorney understands all of the facts about your income, parenting time, and your children to work out the nuances and exceptions that are so typical of child support law.

Spousal Maintenance

Spousal maintenance is meant to assist one spouse in meeting his or her necessary monthly living expenses when the other spouse has the ability to provide that assistance. Spousal maintenance is not intended to equalize the incomes of the parties. In considering whether spousal maintenance should be ordered in a case, we look to the income and necessary monthly living expenses of each party. Sometimes, determining the parties’ incomes alone can be very complicated and the source of much disagreement. The standard of living enjoyed by the parties during the marriage helps determine what a reasonable and necessary expense is after the completion of the divorce.

If one party has a significant deficit in his or her budget, and the other party has a surplus, then it would appear that one party has a need for maintenance and the other party has an ability to pay maintenance. In that case, spousal maintenance may be ordered. Judges have wide discretion in determining whether spousal maintenance should be paid as well as the amount and duration of the payments.

At Johnson/Turner we regularly represent clients in spousal maintenance cases both seeking spousal maintenance and challenging requests for spousal maintenance. Spousal maintenance is inherently complex, and if you believe it will be a part of your divorce case, you should absolutely schedule a meeting with an attorney to discuss it.